Technology and regulatory trends in direct-to-consumer genomics testing

Genomics is the study of an entire set of DNA within an organism. It includes researching the molecular components, structures and functions of their genes as well as developing the technologies that aim to map and edit sequences of DNA.

What began as a purely scientific endeavour has evolved quickly into a commercial offer, with companies using genomic technologies for personal, direct-to-consumer testing.

This has given consumers unprecedented insights into their health, well-being, and even family ancestry.

Players in the direct-to-consumer genomics market range from small private companies to very large corporations. Because direct-to-consumer genetic testing has grown so rapidly, it has generated a lot of investment, revenue and public interest, but also regulation. This article takes a look at the current trends in both technology and regulation in this growing market.

Technology

There are two major types of technology used for direct-to-consumer genetic testing: single nucleotide polymorphism (SNP)-BeadArray chips or microarrays, and next-generation sequencing.

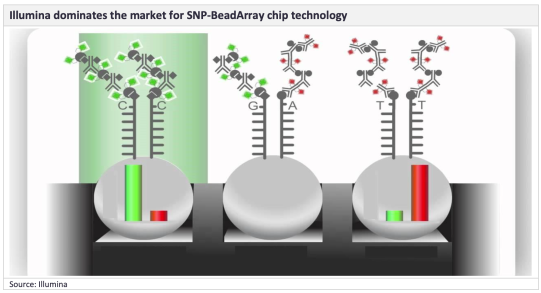

SNP-BeadArray chips

Market leaders such as 23andMe, Ancestry.com, and FamilyTreeDNA use SNP-BeadArray chip technology. While Illumina dominates this market, Thermo Fisher Scientific also provides products in this space. One of the most popular is the Illumina OmniExpress chip which is used by 23andMe, Ancestry.com, MyHeritage, and FamilyTreeDNA.

The Illumina OmniExpress chip contains approximately 570,000–967,000 SNPs and is designed to provide high sample throughput as well as coverage of common variants.

A major advantage of the GSA is its multi-ethnic capabilities. The GSA chip is more inclusive of world populations, with the previous OmniExpress chip mainly only being applicable to European individuals.

Next generation sequencing

Some newer companies - Color Population Health, Helix OpCo LLC, Invitae Corp, and Sema4 - are now using next-generation sequencing technology.

These products involve either targeted analysis, where libraries are enriched for pre-selected genes, or whole-exome sequencing.

Next-generation sequencing provides superior data that can be used to analyse a much broader range of genes and mutations. Illumina and Thermo Fisher Scientific Inc. are market leaders in next-generation sequencing analysers and reagents.

Technology Trends

The switch from the Illumina OmniExpresschip to a customised Illumina global screening array (GSA) microarray.

One of the most popular SNP-Bead Array devices previously used by direct-to-consumer genetic testing companies is the Illumina OmniExpress chip.

It has been used by some big players - 23andMe, Ancestry.com, MyHeritage, and FamilyTreeDNA.

Then in 2017, 23andMe switched from using the Illumina OmniExpress chip to a customized Illumina Global Screening Array (GSA) microarray. MyHeritage, and FamilyTreeDNA followed suit recently

Sources now indicate that Illumina intends to discontinue its OmniExpress chip, in favor of the GSA product.

This means that companies such as Ancestry.com who continue to use this device will now be forced to switch to the GSA, purchase Thermo Fisher Scientific products, or adopt next-generation sequencing technology.

The shift from SNP BeadArray chips to next-generation sequencing

Next-generation sequencing will eventually surpass SNP BeadArray chips as the main technique this kind of testing – mainly due to costs.

Next-generation sequencing costs are falling dramatically Big manufacturers such as Illumina have already said they intend to cut the cost of next-generation sequencing down to $100 per genome.

Regulation Trends

FDA classification of direct-to-consumer genetic tests as class II medical devices

The FDA classified 23andMe’s personal genome service (PGS) genetic health risk report for 10 separate diseases as a class II medical device in April 2017.

These were: Hereditary Thrombophilia, Alpha-1 Antitrypsin Deficiency, Alzheimer’s Disease, Parkinson’s Disease, Gaucher Disease Type 1, Factor XI Deficiency, Celiac Disease, G6PD Deficiency, Hereditary Hemochromatosis, and Early-Onset Primary Dystonia.

Then in April 2018, the 23andMe PGS for BRCA1/2 was then also classified as a class II medical device, allowing 23andMe to sell its products within the US without the need for physician oversight.

Most of the concerns are around the generation of false positives and negatives.

False positives could lead to unnecessary follow-up testing, imaging, medication, restrictive diets, invasive procedures, and/or surgery as well as anxiety or depression, and inappropriate lifestyle choices and reproductive decisions.

Therefore, the FDA specified that any positive test results should be confirmed in a clinical setting prior to any medical intervention.

False negatives could delay the identification of genetic diseases, resulting in inadequate follow-up and treatment, increased morbidity and mortality.

The FDA noted that this concern could be mitigated by making sure users understood the product, better labelling, and special controls.

Laboratory-developed tests (LDTs) sold with physician oversight

This is where users are required to fill out a questionnaire considering their medical history when they order a report. This medical history is then reviewed by a physician who aims to identify high-risk individuals, who would then be precluded from taking the test. This is to encourage them to seek genetic counselling and/or clinical laboratory testing via their healthcare provider.

In short, it is generally accepted that high-risk individuals should undergo more thorough and in-depth testing that current direct-to-consumer products cannot provide.

The Genetic Information Non-discrimination Act, US

This is US federal legislation made law on May 21, 2008. It prohibits the discrimination of individuals based on genetic information, with respect to health insurance and employment.

It makes it illegal for health insurance providers to require or use genetic information, in order to make decisions about customer eligibility, premiums, contribution amounts, or coverage.

For example, under GINA an individual who has inherited a genetic mutation that causes Huntington's disease cannot be treated differently in terms of health insurance before they exhibit symptoms of the condition. However, once this individual begins to exhibit symptoms and is diagnosed with Huntington's disease, GINA does not prevent health insurance providers from using this diagnosis to make decisions regarding a person's eligibility for health insurance, as well as their premiums and coverage.

Additional legislation may be introduced in the coming years to improve US regulation of in vitro clinical devices. FDA exempts subsequent genetic testing devices from 510(k) premarket approval In June 2018, the FDA published a notice exempting certain direct-to-consumer genetic tests from requiring 510(k) premarket approval.

Companies such as 23andMe who sell a direct-to-consumer genetic testing device that has already undergone a one-time premarket review, will no longer be required to submit a 510(k) for any subsequent devices they develop.

What’s more, companies found making false claims will be subject to FDA sanctions.

Posted by Jamie Knowles, Senior Consultant - BioTech

[All Information Sourced for Global Data]