POSTED BY

John Swift

A Year of Firsts & Records

This year to date has proven to be huge for regenerative medicine as there have been many firsts in the sector thus far– AND it’s likely that even more records will break before 2021 is out. This includes the highest number of regulatory approvals of new gene therapy and gene-modified cell therapy products, positive results from a new CRISPR gene-editing technology deployed in vivo in human patients, and sector financing at an all-time high.

Record-Breaking Financing (again)

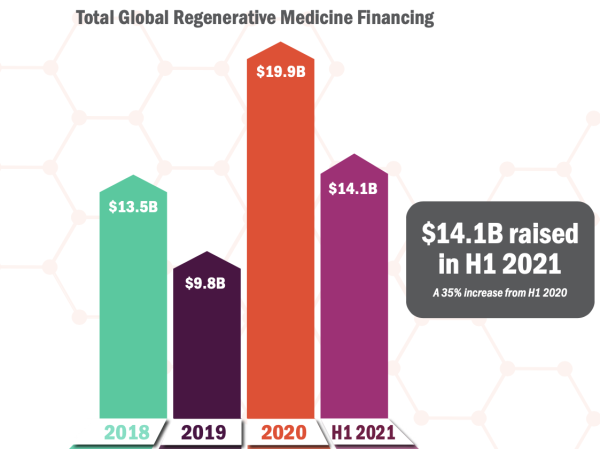

Regenerative medicine and advanced therapies financing have hit new peaks, raising $14.1B in the first half of the year, already at 71% of what was raised in all of 2020.

Despite the challenges of the unprecedented pandemic, 2020 broke records in the sector, raising nearly $20B. As the investment in the sector continues to rise, this year is now set to break new records and is in a solid position to outperform last year, with H1 2021 being the strongest half on record.

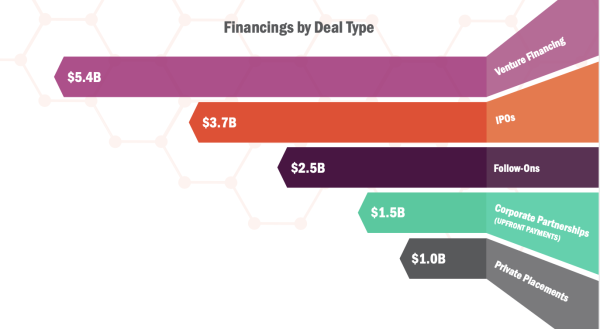

There were 14 cell and gene therapy companies that went public in H1 with 6 additional IPOs already in Q3, the total number rising to 20 so far this year. Therefore, already surpassing 2020’s full-year record of 14. This market is continuing to remain strong, so it seems as if additional companies will follow before 2021 comes to an end.

It’s expected that 2021 is also going to be private placements and venture financing’s strongest year, as private placements totalled $1B and developers raised $5.4B in venture financing in the first half of the year.

For the first time, cell-based immuno-oncology (IO) financing has surpassed gene therapy, raising $6.6B in H1 2021, closing out the first half 232% up from the levels in 2018. For comparison, in 2018 $6.4B was raised by gene therapy developers whereas $1.1B was raised by cell therapy developers.

The demand for internal/external manufacturing continues to grow, as we see this field progress. Smaller cell and gene therapy contract development and manufacturing companies are attractive targets for acquisitions, driving over $10.8B in mergers and acquisitions within the first half of 2021. This includes Danaher’s 9.6B acquisition of Aldervon (a manufacturer of plasmids, mRNA, and proteins) and Charles River Laboratories’ acquisition of CDMOs Cognate BioServices for $875M and Vigene Biosciences for $293M.

As of current, there are 1,195 regenerative medicine and advanced therapy developers across the globe, developing these therapies, which is nearly 200 more than this time last year.

Increasing Number of Product Approvals

Along with financing, we are also seeing and expecting many product approvals within the sector. 18 regenerative medicine products across 6 geographies are expected to receive a decision, with 10 of those on products previously never been approved in any geography. Yes- that means new product approvals are likely to exceed the 2016 set record of 9 total. As of current, 4 have already been approved in 2021 including:

- Breyanzi (Bristol Myers Squibb) – US (Feb. 2021) Japan (March 2021) – R/R diffuse large B cell lymphoma

- Skysona (bluebird bio) – EU (July 2021) – Cerebral adrenoleukodystrophy

- Abecma (BMS & bluebird bio) - US (March 2021) Canada (May 2021) - R/R multiple myeloma

- Stratagraft (Mallinckrodt) – US (June 2021) – Severe burns

3 out of 4 are gene therapy/gene-modified cell therapies likely to be approved (Breyanzi, Abecma, and Skysona) - meaning this year is likely to set yet another record for new approvals within this specific category of products. It’s evident that even more decisions are due to be made in 2021, with 4 more gene therapy/gene-modified cell therapies expected to be approved, equating to 7 total approvals, which would double the previous record set in 2017 of 3 total.

Clinical Milestones & Scientific Trends:

Across the globe, there are 1,320 industry-sponsored regenerative medicine and advanced therapies trials ongoing at present. That would be an increase of 100 trials since the end of 2020.

The CAR-T field continues to advance with Johnson & Johnson and Legend Biotech reporting data from their BCMA-targeted CAR-T therapy cilta-cel in June, which showed a 98% overall response rate and an 80% stringent complete response rate in multiple myeloma. Decisions from the EMA and FDA on cilta-cel are anticipated later this year. This shows that there is growth in the number of readouts from CAR-T with BCMA since the first approved BCMA-targeted CAR-T therapy from Abecma.

Gene editing is also continuing to advance in the clinic. The announcement of Intellia Therapeutics promising clinical data from transthyretin (ATTR) amyloidosis made headlines as the first data from a vivo CRISPR therapy. This is only the beginning, new gene-editing technologies, like this one, open the door for a new era of medicine that has the potential to cure genetic disease.

Automation is also gaining a significant amount of traction in the sector, a strategy for large-scale manufacturing. This is likely to play an essential part in producing therapies at scale, with an emphasis on the number of approved therapies. Along with substantial cost-savings, fully automated manufacturing platforms help with decreasing the chance of potential errors that could contribute to failure in cell therapy manufacturing.

With so many records already broke, or on the brink of breaking and the sector currently thriving with a strong financial environment to fund it, it is expected to continue to grow. These companies fast-track scientific and clinical developments and bring truly life-changing therapies to patients all around the world. I look forward to seeing what the next few months of 2021 bring to the sector.

[Information/Images sourced from Global Data PLC]