POSTED BY

John Swift

Top Trends in Immuno-oncology - a 2022 recap

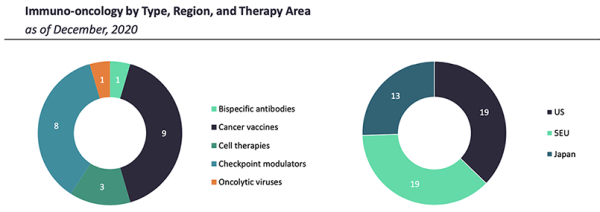

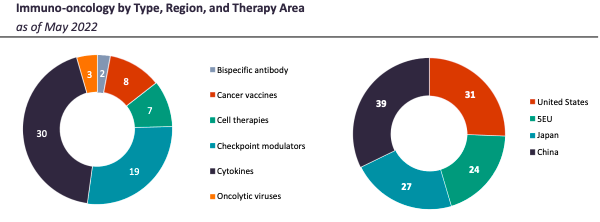

Immuno-oncology is where pharmaceutical products or biologics are used to stimulate a patient’s own immune system, helping it recognise and attack cancer cells.

Immuno-oncology has quickly changed the therapeutic landscape in the last few years. In 2021 we took a look at how it was continuing to benefit many cancer patients. As such a thriving field – with a range of new trends, innovations, challenges and developments – even a year is a long time.

We are revisiting the five main areas where significant advancement is being made, to see what developments have made an impact in the last 12 months.

This document focusses on bispecific antibodies, cancer vaccines, cell therapies, checkpoint modulators, and oncolytic viruses.

Bispecific Antibodies

Bispecific antibodies offer a number of new options when traditional therapies fail. Although the bispecific antibody field has generated a lot of excitement in oncology recently, some of that slowed down in 2022.

In 2021 the oncology field saw the first FDA approval of a non-CD3 bispecific antibody (Rybrevant; for non-small cell lung cancer.)

GlobalData’s research shows many influential practitioners see bispecific T-cell engagers as a great combination partner for checkpoint modulators and other IO therapies.

IN 2022, the percentage of high-prescribers surveyed by GlobalData who use bispecific antibodies as part of their regular practice or as part of clinical trials rose 84% to 94%, with 34% now saying they believe a combination of a bispecific antibody with a checkpoint modulator is the most promising approach.

Cancer Vaccines

The cancer vaccine field maintains much of the industry’s interest into 2022, with future efforts starting to focus on mRNA vaccines.

Concerns over single-agent efficacy have recently caused a shift in vaccine studies towards less-demanding lines of therapy, such as adjuvant.

A major development for 2022 is that cancer vaccines based on mRNA are expected to make a comeback after the success of mRNA vaccines in the treatment of COVID-19 in the last two years.

Simple peptide vaccines are ideal as well-tolerated maintenance regimens, and this is reflected in new studies. Use of vaccines to prime the immune system for a more potent combination partner to more fully elicit anti-tumor responses looks set to increase too.

Despite this, according to GlobalData’s most recent research, the high-prescribers who have used cancer vaccines as part of their regular practice or as part of clinical trials has actually fallen in 2022 from 53% to 49%. Last year, only 18% believe that a combination of a cancer vaccine with a checkpoint modulator is the most promising approach in their field. This has now fallen to 6%.

Cell Therapies

Cell therapy field is having an impact more broadly today, and importantly now offers curative options in some blood cancers.

In 2021, it was clear that the Cell Therapy field was expanding, but with a need for improved academic expertise and manufacturing. Yescarta (Gilead), Tecartus (Gilead), Breyanzi (BMS), and Kymriah (Novartis) are still the only cell therapies currently approved by the FDA.

Many CAR-T therapies are now in development in 2022, with over 800 clinical trials testing their safety and efficacy. The initial success of CAR-T cells in hematologic malignancies has led to a massive effort for expansion into use as a therapy for solid tumours.

Since last year, BMS’s Abecma and Johnson & Johnson’s (J&J’s)/Legend Biotech’s Carvykti have been approved for relapsed/refractory (R/R) multiple myeloma, raising the total number of marketed cell therapies to six.

GlobalData’s 2022 research shows that many believe that a lack of good tumour antigens and heterogeneity may have held back cell therapies for solid tumours. Despite this, they are optimistic about new approaches in the next five years.

A total of 78% of high-prescribers surveyed by GlobalData this year have used cell therapies as part of their regular practice or as part of clinical trials – up from 69%. A total of 38% of high-prescribers surveyed by GlobalData are ready to prescribe cell therapies in the 1st line if they were approved.

Checkpoint Modulators

The checkpoint modulator field is considered the most innovative modality in oncology since chemotherapy.

Tumour-agnostic examples have appeared in 2022 and there is increasing incorporation of biomarker testing both in labels and in new clinical trials.

There is a key recent trend with the trials in combination with a diverse array of therapies. GlobalData’s 2022 research found that 31% of high-prescribers believe that a combination of a checkpoint modulator with another checkpoint modulator is the most promising approach in their field, while 29% believe that the most promising combinations include costimulatory drugs, oncolytic viruses, or other IO agents.

The clinical use of checkpoint modulators by high prescribers as part of their regular practice or as part of clinical trials was the highest among the five classes of IO.

Oncolytic Viruses

The oncolytic virus field seems still to be held back by the limitations of intra-tumour administration and suboptimal clinical development.

KOLs are excited about the option of bringing a variety of payloads into the tumour microenvironment using viruses.

There has been increased use of next-generation, innovative approaches to achieve tumor cell lysis, such as the expression of cytokines, the expression of checkpoint molecules.

GlobalData has seen a slight drop in 2022 – from 36% to 35% - in the number of high-prescribers who use oncolytic viruses as part of their regular practice or as part of clinical trials.

Influential practitioners interviewed by GlobalData in 2022 believe that oncolytic viruses remain an exciting prospect and all that remains is to find the specific cancer types where their efficacy is most pronounced.

Conclusion

Immuno-oncology is still a fast-growing sector in 2022. Despite some set-backs in 2021 and 2022, the overall effect of the pandemic has seemed to add to the impetus, and there is a continuing investment in a diverse array of innovative immuno-oncology therapies. This is mirrored by the growing use by high-prescribers almost across the board.

These new treatments represent a significant growth in less invasive, more effective and affordable immuno-oncology therapies. Their ongoing development and strong adoption in the oncology sector will continue to save lives and improve outcomes for increasingly diverse patient groups.